Mutual Funds

A mutual fund is an investment vehicle that aggregates funds from multiple investors to acquire a diversified portfolio of stocks, bonds, or other securities. Each investor holds shares representing a proportion of the fund’s holdings.

Key Features:

• Diversification: Reduces risk by investing in a range of assets.

• Professional Management: Managed by experienced fund managers.

• Liquidity: Shares are easily bought and sold.

• Affordability: Enables small investments from individual investors.

• Regulation: Oversaw by financial regulatory authorities for investor protection.

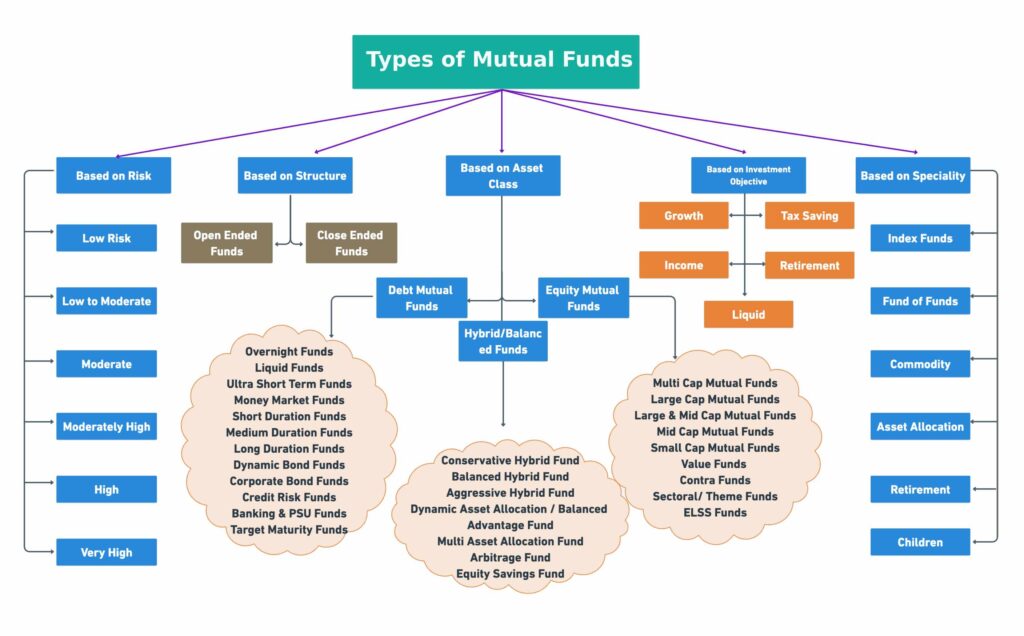

Types of Mutual Funds:

• Equity Funds: Primarily invest in stocks for growth.

• Debt Funds: Focus on fixed-income securities such as bonds.

• Balanced Funds: Combine equities and fixed-income instruments.

• Index Funds: Track specific market indices.

• Money Market Funds: Invest in short-term, high-quality investments.

Benefits:

• Potential for Higher Returns: Compared to traditional savings.

• Reduced Individual Stock Risk

• Convenience: Suitable for passive investors.

Risks:

• Market Fluctuations: Impact returns.

• Management Fees and Expenses.

Investment Process:

• Determine Investment Goals.

• Based on risk tolerance.

• Invest Through Financial Institutions or Online Platforms.

• Regularly Monitor Fund Performance.

Mutual funds provide a flexible, diversified, and professionally managed investment option for both novice and experienced investors.